KSA Salary Guide 2024

Welcome to the 2024 edition of the Cooper Fitch Salary Guide for Kingdom of Saudi Arabia. Please fill out the form below to recieve a copy of the Kingdom of Saudi Arabia Salary Guide 2024 published in 2024

Kingdom of Saudi Arabia Salary Guide 2024

Introduction

Welcome to the 2024 edition of the Cooper Fitch Salary Guide for Saudi Arabia.

It has been a milestone year for the Kingdom of Saudi Arabia (KSA), as it passed the halfway line between the 2016 launch of Vision 2030 and the programme’s endpoint. While KSA’s decision to reduce oil production to its lowest level in two years resulted in lower year-on-year revenues, the International Monetary Fund (IMF) expects that non-oil growth will remain close to 5% in 2023.

Development remains a major focus for the Kingdom, with significant progress made across the nation’s portfolio of gigaprojects. Red Sea Global, for example, announced its intention to open three hotels – St. Regis Red Sea Resort, Nujuma Ritz Carlton Reserve and Six Senses Southern Dunes – by 2024. The total value of KSA’s announced real estate and infrastructure projects has passed the $1.25 trillion mark according to Knight Frank, and CBRE estimates that the nation accounts for a staggering 64.5% of all projects currently planned or underway in the GCC.

Saudi Arabia’s burgeoning sports and esports sectors have enjoyed a strong year too. The Saudi Pro League welcomed a selection of world football’s biggest stars in 2023, in line with government targets to quadruple the league’s revenues to $480 million by 2030. Building on last year’s $1.5 billion acquisition of ESL Gaming and FACEIT by KSA-based Savvy Games Group, the Kingdom has also unveiled plans to develop a $500 million ‘esports city’ in Riyadh.

Against this backdrop, Saudi Arabia’s recruitment market has witnessed robust levels of activity. Unemployment fell to 5.1% in Q1 2023, and the Kingdom appears to be experiencing an extra boost from increasing numbers of women entering the workforce – a factor that is expected to bolster the nation’s economy to the tune of $39 billion by 2032 according to S&P Global Ratings.

Introduction

Despite macroeconomic headwinds on the global stage, Saudi Arabia’s economy has demonstrated impressive resilience during the past 12 months. Encouragingly, the Kingdom’s PIF-backed gigaprojects have transitioned from their design and construction phase to near handover. These developments already appear to be serving their purpose, stimulating economic diversification while creating new business ecosystems that are likely to make significant contributions to the national coffers in years to come.

In its latest report, the IMF revised its KSA growth forecast for 2023, lowering it to 0.8%. However, the international body expects non-oil growth of approximately 5% this year, and believes that the nation’s gross domestic product (GDP) will increase by 4% in 2024.

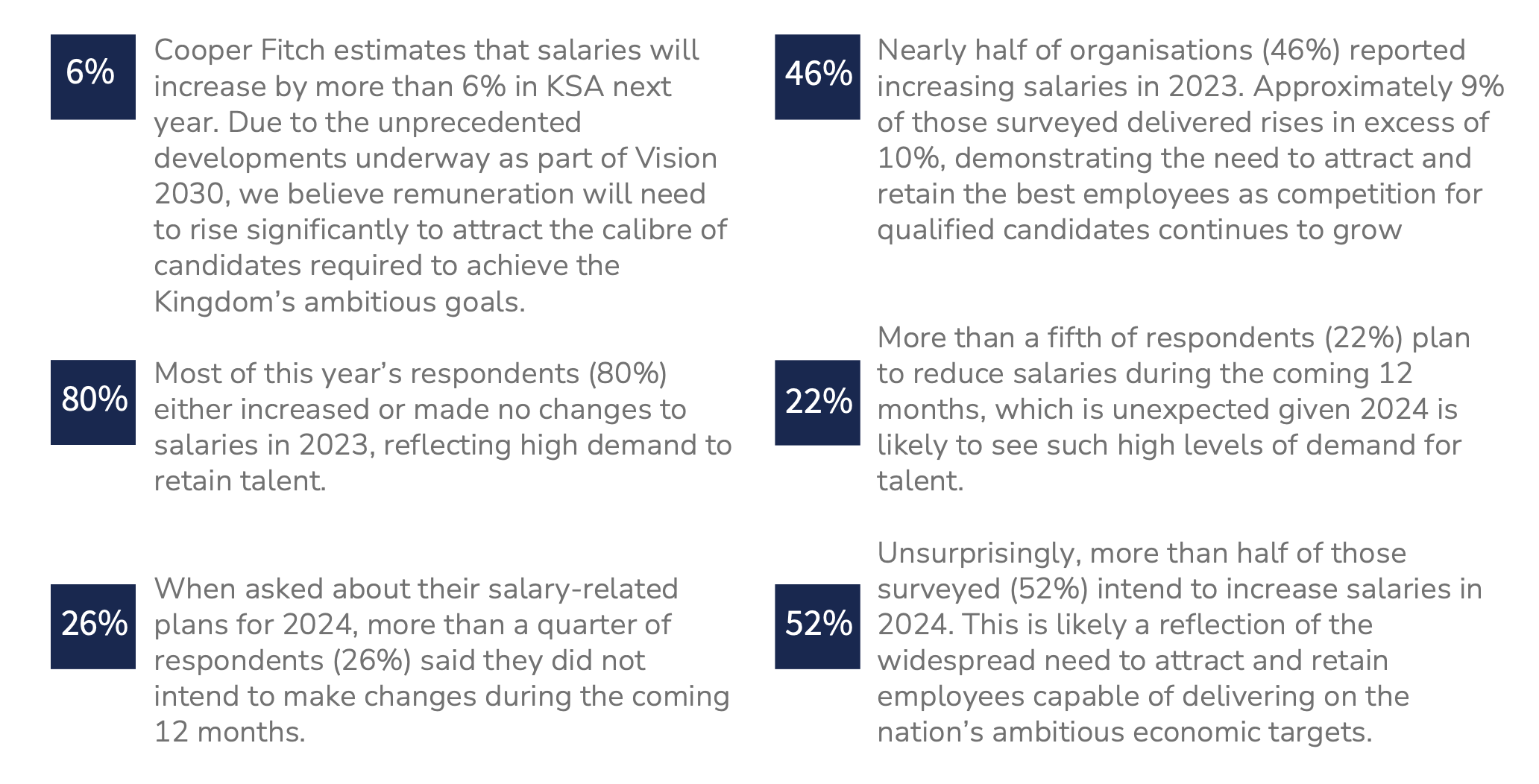

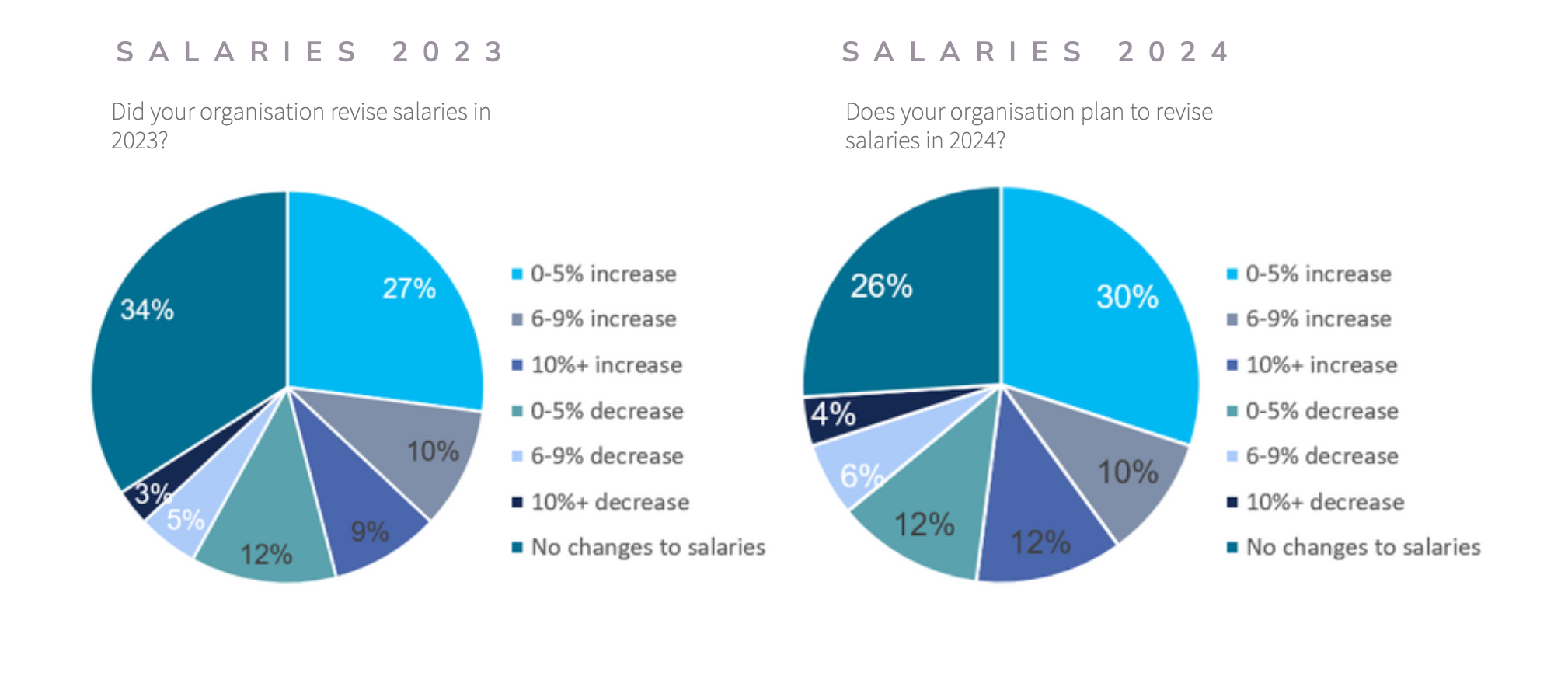

In line with these economic forecasts, recruitment trends we have witnessed in the market, and the responses used to compile this guide, Cooper Fitch expects salaries in Saudi Arabia to increase around 6% in 2024.

“In line with the realisation of Vision 2030, Saudi Arabia’s portfolio of gigaprojects and the development of new industries such as electric vehicles have positively impacted recruitment and remuneration over the past year. Industries across the Kingdom are expanding, along with major cities such as Jeddah and Dammam.”

Vilius Dobilaitis, Managing Partner – Finance, Sales and Marketing, Cooper Fitch

Headcount in KSA

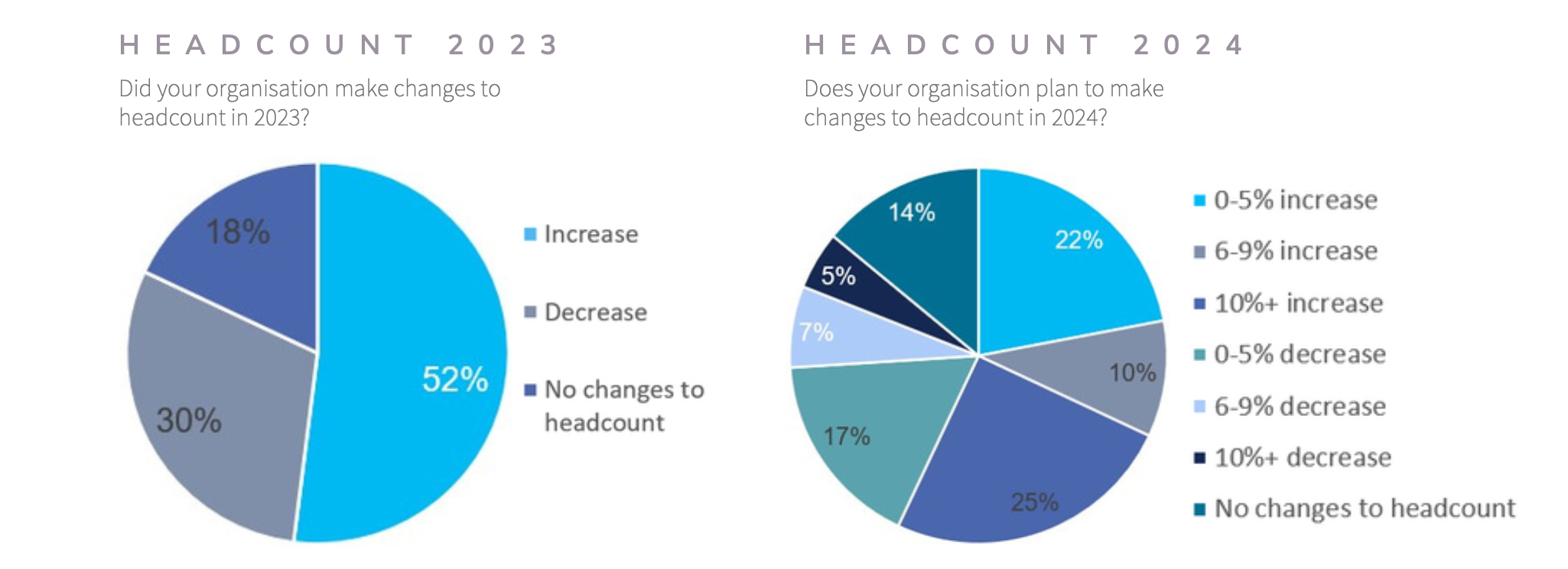

Nearly one-third (30%) of KSA-based organisations surveyed made headcount reductions in 2023, while just over half (52%) increased their numbers. These figures compare unfavourably with those re3corded last year, when 21% of respondents reduced their headcount and 57% grew their teams. Looking ahead, 57% of respondents expect to increase their headcount in 2024, while 29% are preparing to reduce the size of their workforces.

Overview

Bonus Outlook

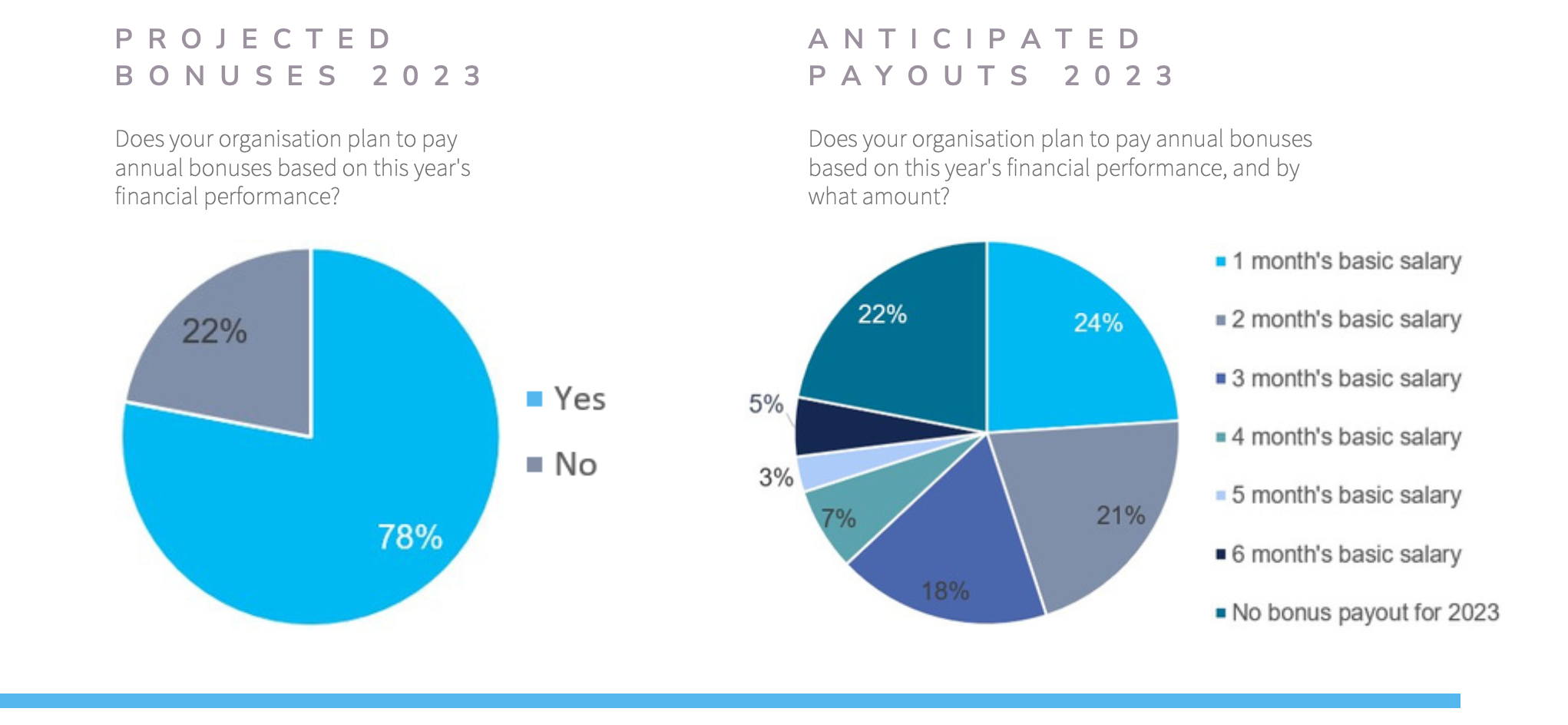

More than three-quarters of this year’s respondents (78%) reported their intention to issue annual bonuses based on their organisations’ financial performance in 2023, compared to 22% that had no such plans. The largest share of this year’s respondents that intend to issue bonuses (24%) expect to pay one month’s basic salary. More than a fifth (21%) plan to pay two months’ salary, 18% said three months, 7% said four months, and 3% said five months.

Employees working for 5% of this year’s respondents – spanning the fields of consulting, financial services, investment management, real estate and telecommunications – will receive annual bonuses amounting to a generous six months’ basic salary.

Of the 22% of companies that do not intend to pay bonuses, the highest proportions operate in the fields of construction and consulting. This is unexpected given the unprecedented levels of development currently taking place in Saudi Arabia, as the nation pushes ahead with a slew of large- scale projects related to Vision 2030. Equally concerning is the fact that fewer than half of these construction and consulting firms intend to raise salaries in 2024. Organisations that find themselves in this position are likely to struggle to attract and retain the best talent in such a competitive recruitment market – especially among Saudi Arabian nationals.

To ensure the highest possible accuracy of this year’s bonus-related information, Cooper Fitch surveyed senior-level representatives from businesses across multiple sectors. Managers (28%), directors (18%) and HR professionals (15%) represented the largest proportions of respondents, meaning they are ideally placed to comment on their organisations’ anticipated bonus payouts.

“As a testament to their dedication to Saudi Arabia and a strategic effort to reduce travel expenses, consulting firms are reserving limited space in their Dubai offices for recruitment, placing a strong emphasis on bolstering their presence in the Kingdom. This commitment is reflected in a slight premium in salaries of around 10% when compared to their counterparts in the UAE.”

Michael Stubbs, Managing Partner – Strategy, Technology and Management Consulting, Cooper Fitch

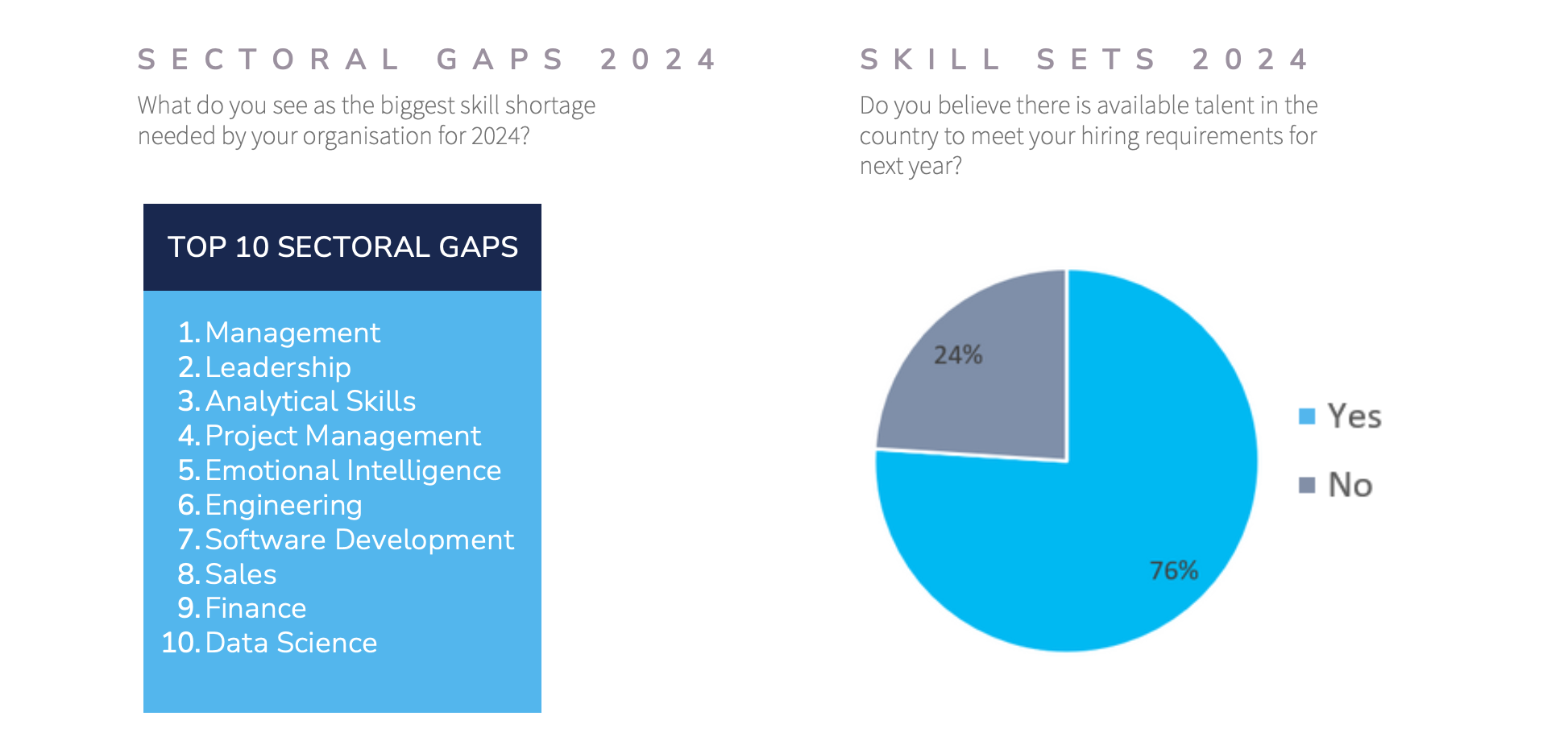

Talent Outlook

Talent acquisition is likely to represent a key challenge in 2024. When asked whether or not there is available talent in Saudi Arabia to meet their hiring requirements during the coming year, more than a quarter of respondents (26%) said there was not. ‘Management’ and ‘leadership’ represented the most significant talent gaps among those questioned this year, accounting for 20% and 16% of responses, respectively. ‘Analytical skills’ was the third-highest deficit identified at 11%.

Encouragingly, KSA has taken several measures to sure up its recruitment sector during the past 12 months, with a focus on quality over quantity. In July 2023, the Ministry of Human Resources and Social Development (HRSD) announced the expansion of its Skill Verification Program (SVP). In August, it introduced new rules to improve standards among recruitment agencies operating in the Kingdom.

Only time will tell if these measures are sufficient to alleviate the perceived skills shortage, and whether they will target the most appropriate sectors.

Talent Requirements

The fact that 24% of respondents expect a shortfall in available talent in 2024 will no doubt be a

concern for employers, as it indicates that demand for suitable candidates is likely to outstrip supply. Interestingly, ‘management’ and ‘leadership’ occupied the top spots on both this survey and Cooper Fitch’s Salary Guide UAE 2024, suggesting that the Kingdom and the Emirates will need to compete with one another to attract candidates with senior-level experience.

Research Methodology

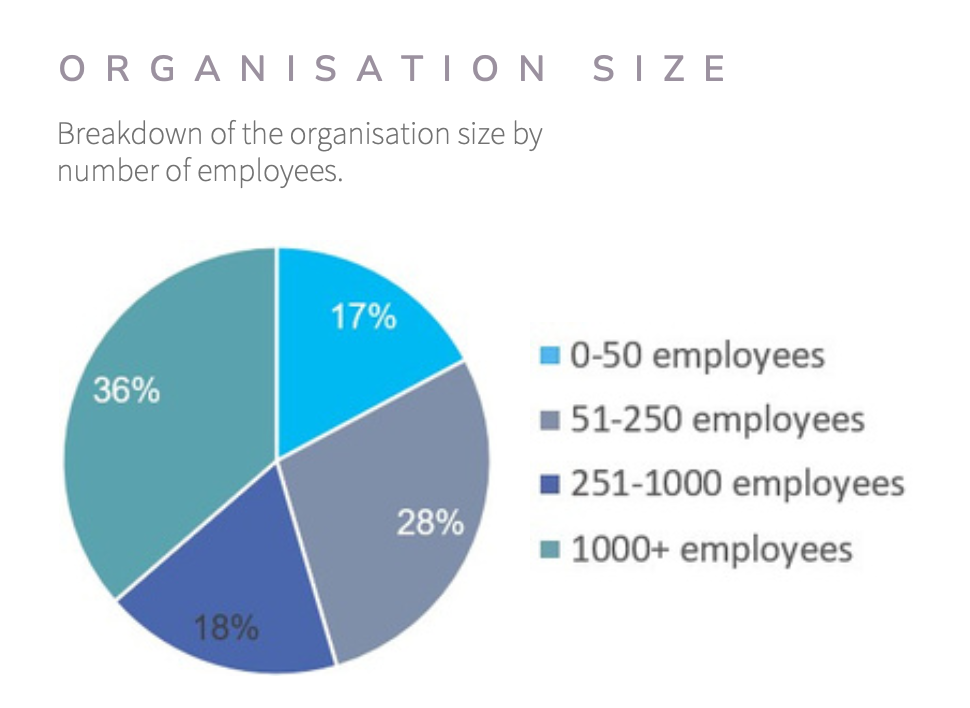

Thisyear,CooperFitchsurveyedbusiness leaders responsible for key decision-making at more than 1,000 organisations across the Gulf region. Our survey posed a selection of 11 confidential questions, which were focused on recruitment activity, organisational headcounts and salary trends across 2023 and into 2024.

The data included in our salary guide is based on the answers we received from our respondents and professional network, and are representative of these responses exclusively.

About Cooper Fitch

Established in 1997, Cooper Fitch provides recruitment, executive search, HR advisory and RPO services across the GCC. Our team supports clients in the Gulf and Europe with all talent-related matters. We are also a proud member of the Talent Club group of companies, with 37 offices across three continents.

Cooper Fitch also offers comprehensive compensation and benefits analysis, which is designed to enhance your organisation’s competitive edge. Please contact me directly if you would like to learn more.

Services

- Recruitment

- Executive Search

- HR Advisory

- Recruitment Process Outsourcing

Trefor Murphy

Founder, CEO

tmurphy@cooperfitch.ae

+971 55 555 7283