UAE Salary Guide 2024

Welcome to the 2024 edition of the Cooper Fitch Salary Guide for United Arab Emirates. Please fill out the form below to recieve a copy of the United Arab Emirates Salary Guide 2024 published in 2024

United Arab Emirates Salary Guide 2024

Introduction

Welcome to the 2024 edition of the Cooper Fitch Salary Guide for the United Arab Emirates.

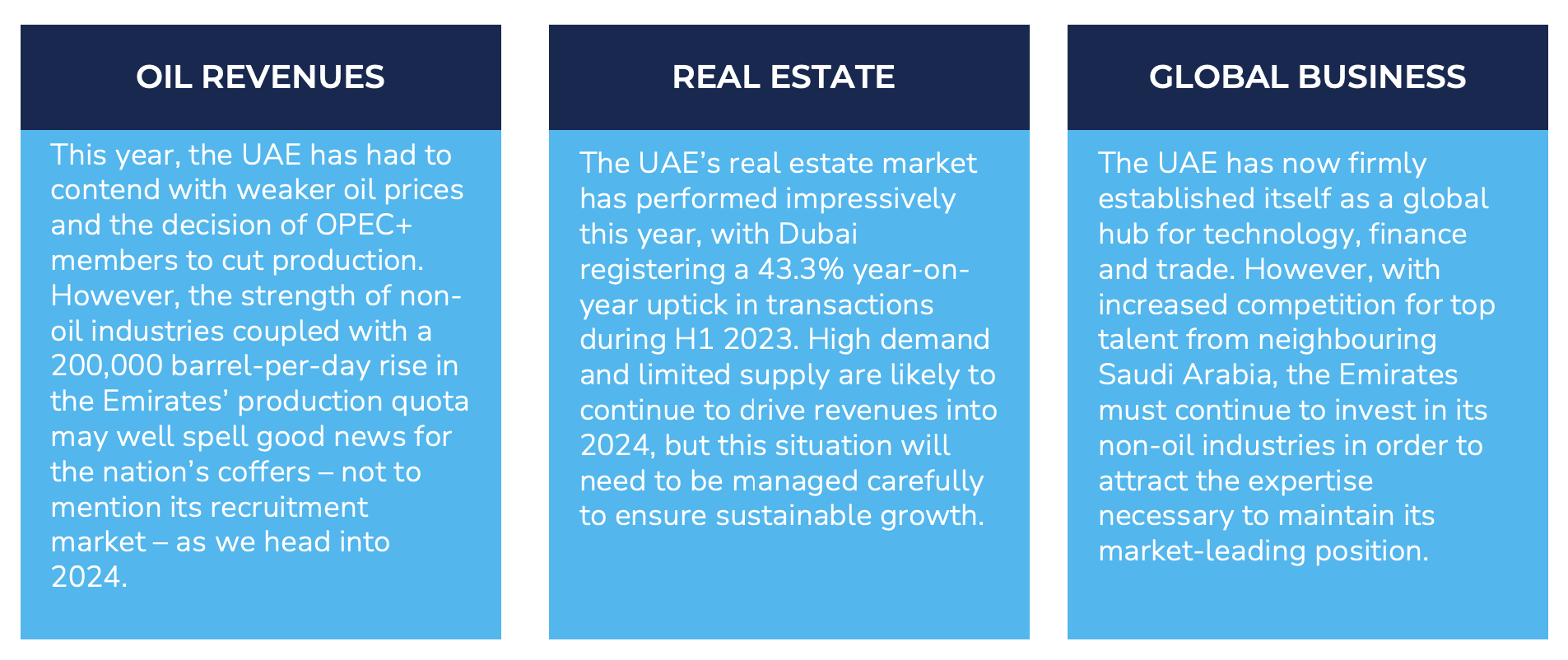

The United Arab Emirates (UAE) has witnessed several positive shifts in its recruitment market over the past 12 months, reflecting the nation’s ongoing commitment to economic diversification and technological innovation. Driven primarily by non-oil sectors, the Emirates’ economy is expected to witness a 3% expansion in 2023 according to analysis from the Swiss Re Institute.

Various sectors are contributing to this growth. CBRE data reveals that approximately $293 billion worth of real estate developments are either planned or underway in the Emirates, accounting for more than one-fifth (21.6%) of all projects in the GCC. The country’s technology sector has also enjoyed a strong year, with ICT spending expected to reach $23 billion in 2024 according to figures released by the UAE Ministry of Economy. With artificial intelligence (AI) on course to contribute approximately $96 billion to the nation’s economy by the end of the decade, qualified and experienced technology candidates are likely to remain in high demand among large tech firms and government entities alike.

Consequently, the UAE’s jobs market remains strong as we head into the new year. While the decision of OPEC+ members to limit production until at least 2024 has served to soften oil-related recruitment activities somewhat, non-oil segments continue to make significant contributions to the nation’s economy. Unemployment fell from 4.3% in 2020 to 3.3% in 2022, and the country’s introduction of unemployment insurance in January 2023 appears to be one of several factors that have had a positive impact on labour participation across the Emirates.

Introduction

In light of oil-related challenges, the UAE’s economy is expected to grow by 3% in 2023 – significantly lower than the 7.9% increase achieved in 2022. Nevertheless, the International Monetary Fund (IMF) expects the country to see non-oil GDP growth of 4%-plus in 2024.

Indeed, the UAE’s non-oil sectors – especially that of real estate – have performed well throughout the past 12 months. Abu Dhabi property deals more than doubled in the first six months of 2023, with 10,557 transactions totalling $12.61 billion. Dubai, meanwhile, topped global luxury rankings selling 176 $10 million-plus homes in H1. Even so, UAE real estate prices remain competitive. In Dubai, the UAE’s priciest market, $1 million will secure 105 sqm, according to data from Knight Frank – over five times more space than in the world’s two most expensive locations, Monaco (17 sqm) and Hong Kong (21 sqm).

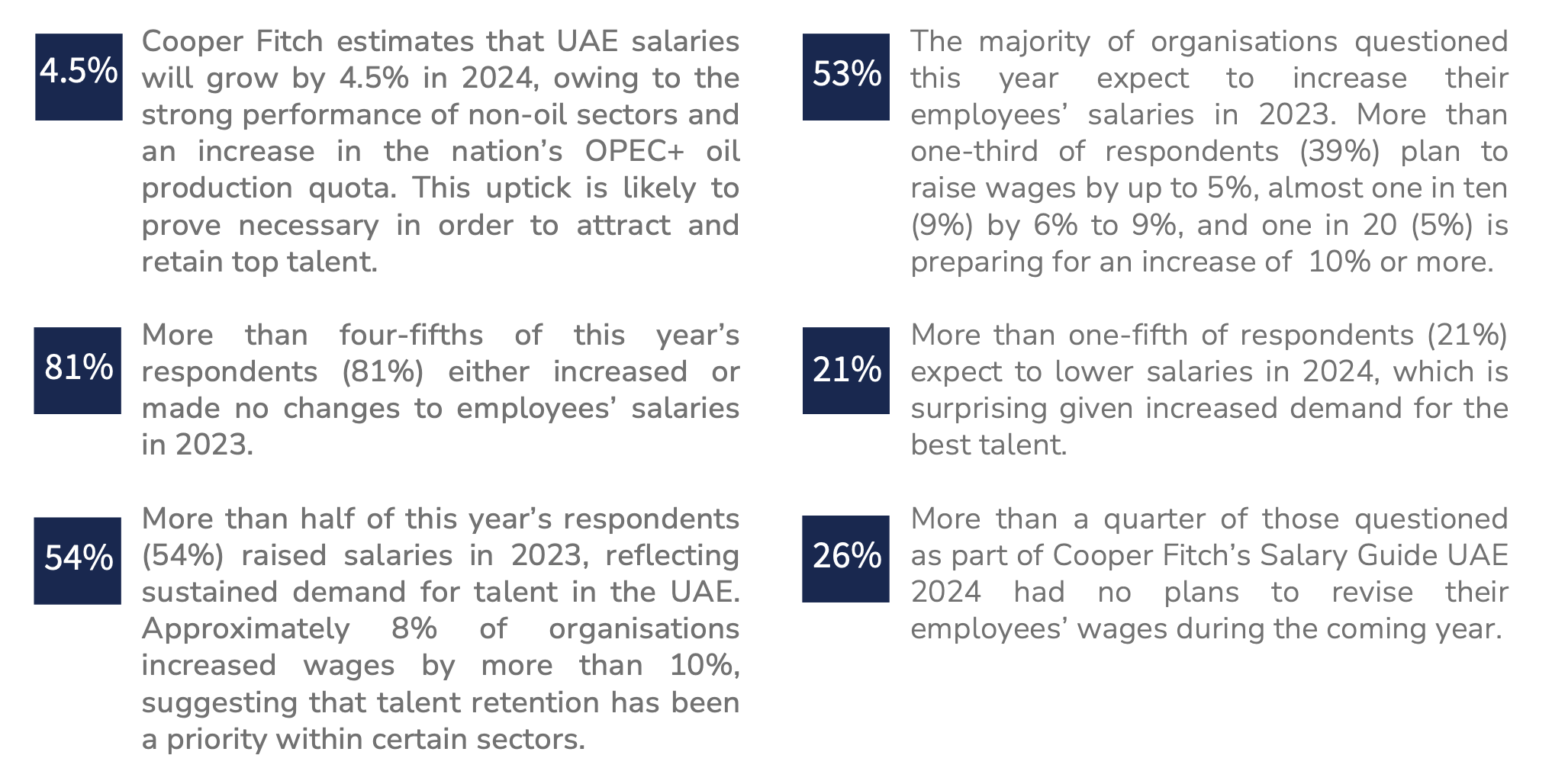

In line with these figures, trends witnessed in the recruitment market and the responses used to compile this guide, Cooper Fitch expects salaries in the UAE to increase by 4.5% in 2024.

“A larger proportion of UAE-based organisations grew their headcount in 2023 than in 2022, and more than half of this year’s respondents intend to increase remuneration in 2024. This is positive news for job seekers in the Emirates as greater demand for talent typically results in higher salaries.”

Trefor Murphy, Founder and CEO of Cooper Fitch

Headcount in the UAE

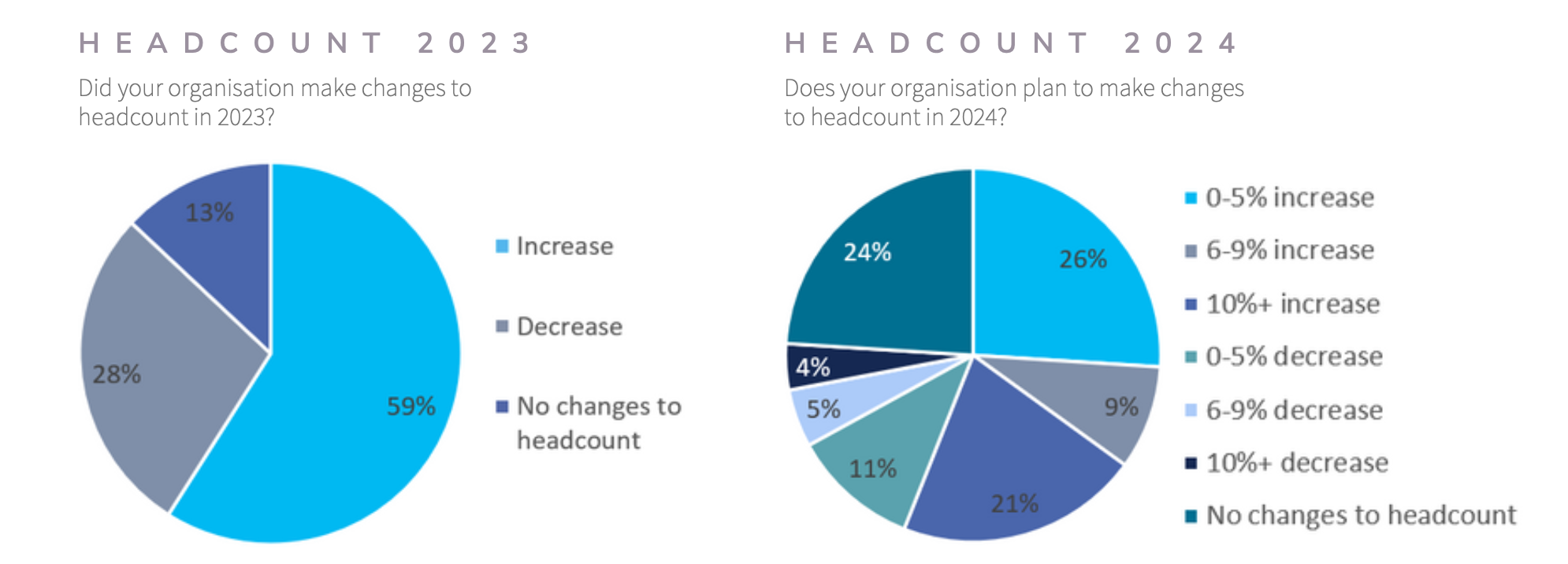

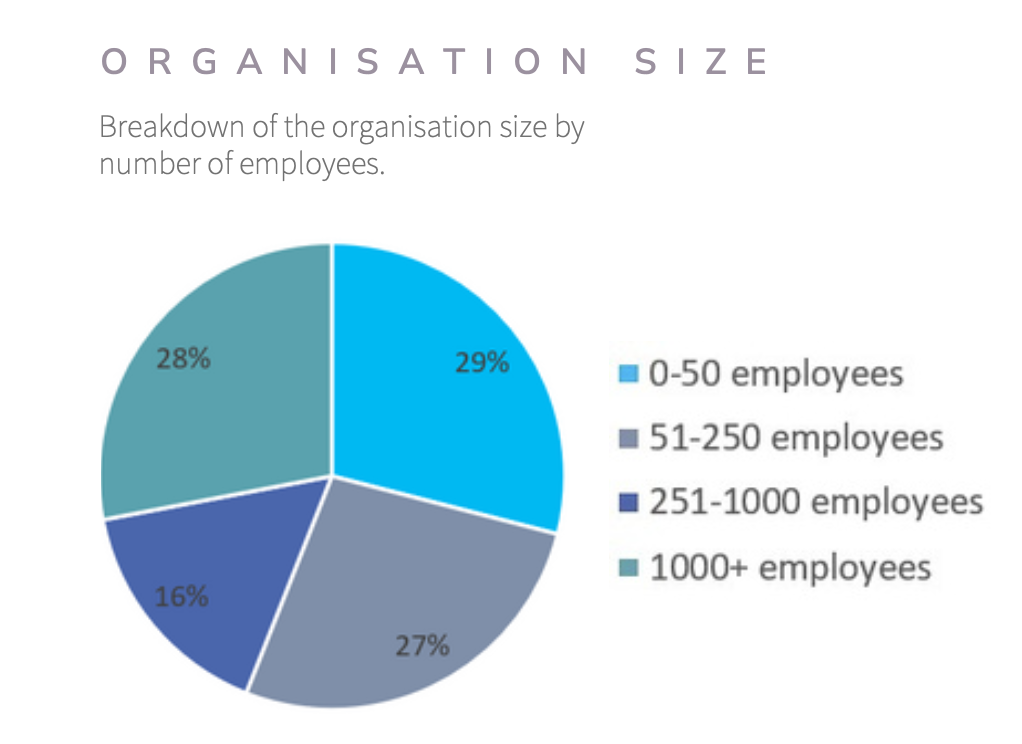

Of the UAE-based organisations surveyed, 28% made headcount reductions in 2023, while an impressive 59% expanded their teams. This compares favourably with last year, when 30% of respondents reduced the size of their workforce and only 55% grew their operations. Looking ahead, 56% of this year’s respondents expect to hire more people in 2024, whereas 20% are planning to reduce their headcount next year.

Overview

Bonus Outlook

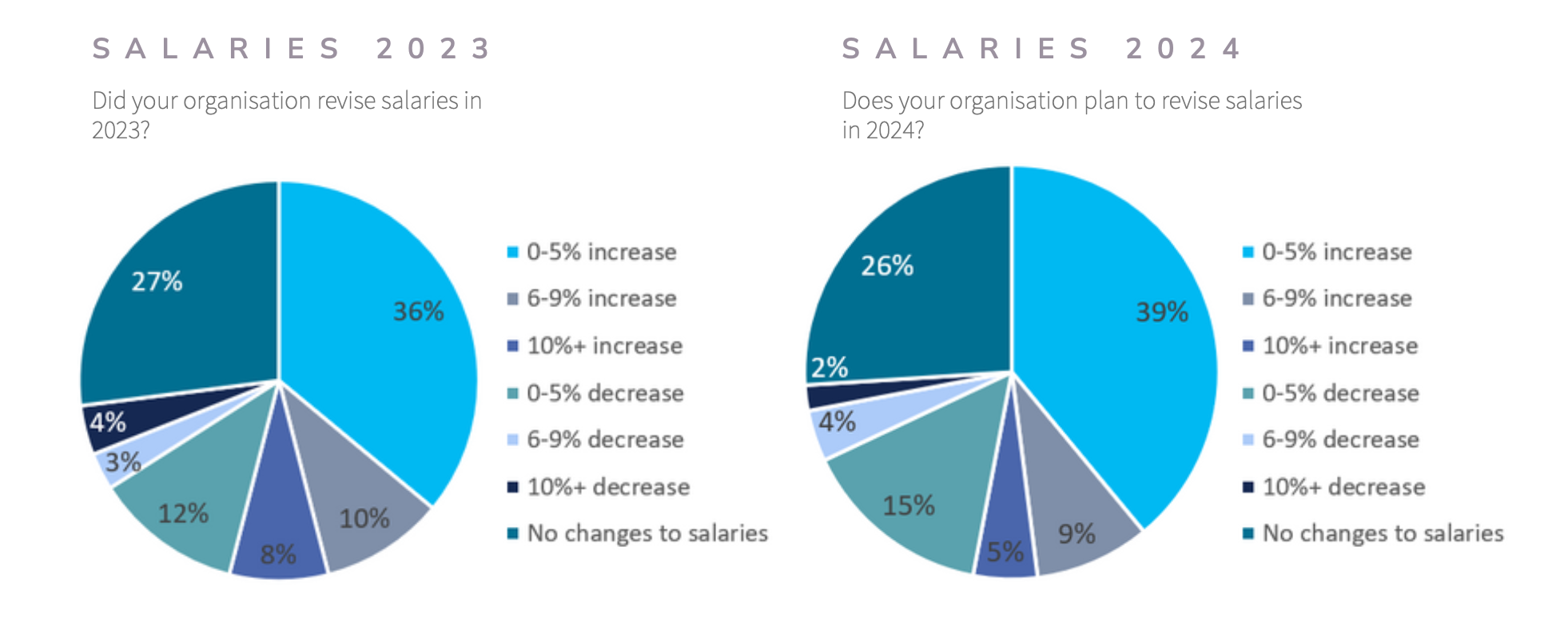

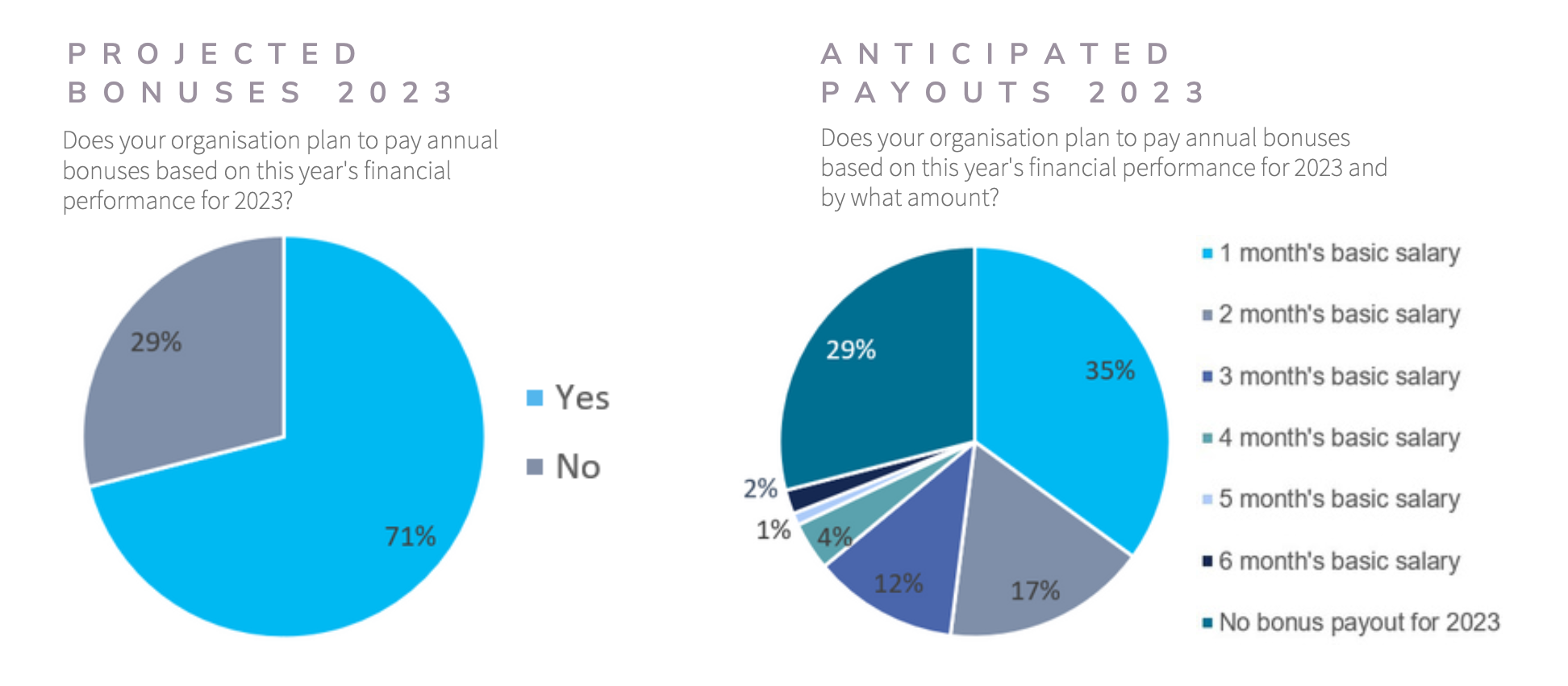

Almost three-quarters of this year’s respondents (71%) reported their intention to issue annual bonuses based on their organisation’s financial performance in 2023, compared to 29% that had no such plans. In 2022, a slightly higher proportion of respondents (74%) planned to pay annual bonuses to their employees.

The largest proportion of this year’s respondents that intend to issue bonuses (35%) expect to pay one month’s basic salary. Almost a fifth (17%) will pay two months’ salary, 12% said three months, 4% said four months, and 1% said five months. Employees working for 2% of this year’s respondents – spanning the fields of accounting, chemicals, consumer goods, and hospital and healthcare – can look forward to bonuses amounting to a generous six months’ basic salary.

Of the 29% of companies that do not intend to pay bonuses, the highest proportion operate in the field of financial services. This is perhaps unsurprising given the economic headwinds that the international banks have faced in 2023.

The second-highest proportion of organisations that do not intend to pay bonuses this year hail from the consulting industry, followed by information technology. In such a competitive job market, firms that do not offer bonuses or increased salaries may need to identify other non-financial benefits – such as remote working, training and development, or additional annual leave – to attract and retain top talent.

To ensure the highest possible accuracy of this year’s bonus- related information, Cooper Fitch surveyed senior-level representatives from businesses across multiple sectors. The largest proportion of respondents (34%) work in HR, meaning they are ideally placed to comment on expected payouts. Directors (22%) and managers (18%) represented the second- and third-highest proportions of those questioned.

“While salaries continue to play a crucial role in talent retention, factors beyond fixed remuneration – such as annual bonuses and the ability to work remotely – are playing an increasingly important role in the UAE’s job market.”

Jack Khabbaz, Managing Partner – CEO & Public Sector Advisory Cooper Fitch

Talent Outlook

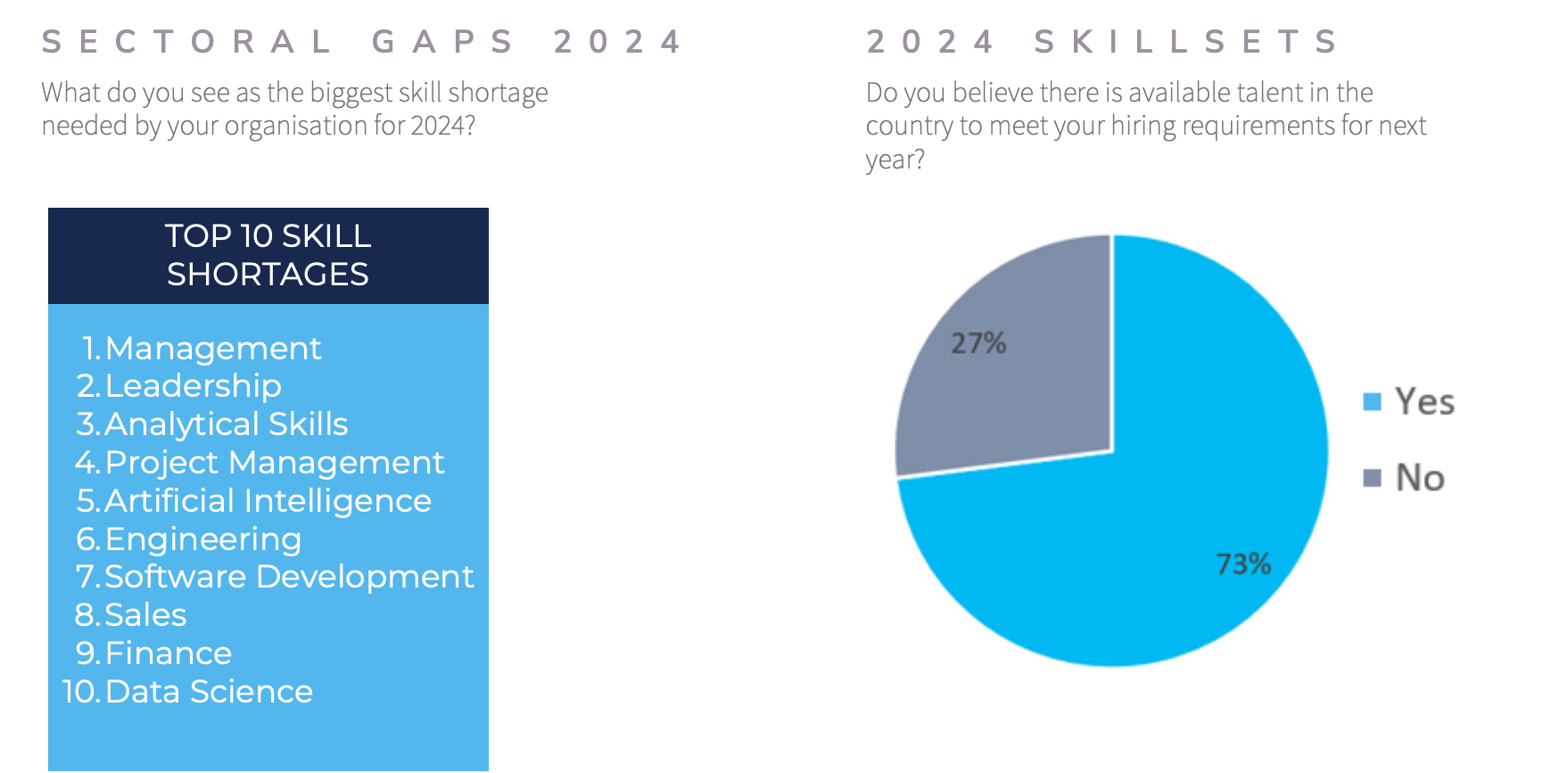

Talent acquisition represents one of the most significant trends uncovered by Cooper Fitch’s Salary Guide UAE 2024. When asked whether or not they believe there is available talent in the Emirates to meet their hiring requirements during the next year, more than a quarter of respondents (27%) said there was not. ‘Management’ and ‘leadership’ were the most significant talent gaps identified by those questioned this year, accounting for 16% and 14% of responses respectively. ‘Sales’ represented the third-highest deficit at 10%.

Fortunately, UAE leaders have adopted a range of measures that should help to minimise the impact of this perceived shortfall. Last year, the country announced a series of reforms as part of its Advanced Visa System, several of which were designed to simplify the relocation process for entrepreneurs, skilled workers and investors. While there is no guarantee these steps will have the desired impact in the short term, ‘job exploration’ and ‘study and training’ visas are likely to positively impact the talent acquisition efforts of Emirates-based employers over the coming years.

The fact that more than a quarter of respondents (27%) anticipate a shortfall in available talent in 2024 is a concern for employers, as it suggests that demand is likely to significantly outstrip supply in the UAE. That ‘management’, ‘leadership’ and ‘sales’ occupy the top three spots on this list is equally worrying, as it suggests a dearth of qualified individuals with senior and revenue-generating experience. We expect to see significant investment, as well as a range of innovative approaches, as UAE-based organisations compete to attract the best candidates next year.

Talent Requirements

Research Methodology

The data included in our salary guide is based on the answers we received from our respondents and professional network, and are representative of these responses exclusively.

About Cooper Fitch

Established in 1997, Cooper Fitch provides recruitment, executive search, HR advisory and RPO services across the GCC. Our team supports clients in the Gulf and Europe with all talent-related matters. We are also a proud member of the Talent Club group of companies, with 37 offices across three continents.

Cooper Fitch also offers comprehensive compensation and benefits analysis, which is designed to enhance your organisation’s competitive edge. Please contact me directly if you would like to learn more.

Services

- Recruitment

- Executive Search

- HR Advisory

- Recruitment Process Outsourcing

Trefor Murphy

Founder, CEO

tmurphy@cooperfitch.ae

+971 55 555 7283